By the Jobpeak.io Team | December 2, 2025

The trucking industry has always been the backbone of America’s economy, hauling everything from groceries to gadgets across our vast highways. But in 2025, a "hidden crisis" is brewing beneath the surface—one that’s forcing fleets to rethink everything from driver hiring to safety protocols. At the heart of it? The Federal Motor Carrier Safety Administration’s (FMCSA) renewed crackdown on English Language Proficiency (ELP) requirements, tied to stricter rules on non-domiciled Commercial Driver’s Licenses (CDLs). What started as a commonsense safety measure has snowballed into a seismic shift, potentially sidelining up to 194,000 drivers and igniting a fierce recruitment scramble.

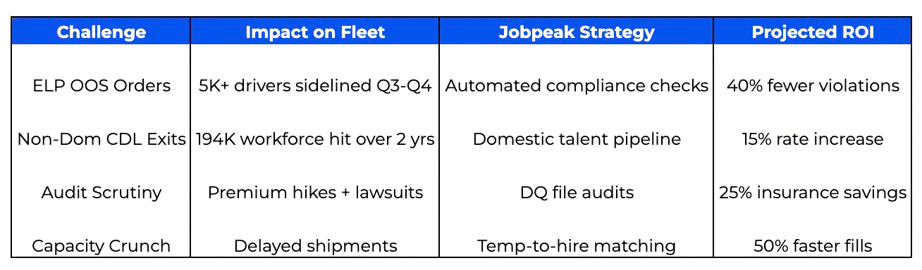

This isn’t just regulatory red tape; it’s a wake-up call. While the immediate pain is a driver squeeze, the silver lining is a "recruitment revival"—a push toward smarter, more sustainable hiring that prioritizes qualified, long-term talent. For fleet managers and recruiters, this means opportunity amid the chaos: higher rates, better retention and a chance to build resilient teams. In this post, we’ll unpack the crisis, its ripple effects and actionable strategies to turn the tide. Buckle up—your next hire could depend on it.

The Spark: What Triggered the 2025 ELP Crackdown?

Let’s rewind to April 28, 2025. President Trump signed Executive Order 14286, Enforcing Commonsense Rules of the Road for America’s Truck Drivers, reviving a long-dormant FMCSA rule from 49 CFR § 391.11(b)(2). This regulation mandates that all CDL holders must "read and speak the English language sufficiently to converse with the general public, to understand highway traffic signs and signals... respond to official inquiries, and to make entries on reports and records."

Why now? Safety. FMCSA cited a string of fatal crashes involving non-English-proficient drivers, including high-profile incidents like the Florida Turnpike U-turn wreck and a Texas sleep-at-the-wheel tragedy—all linked to non-domiciled CDL holders. Enforcement kicked in hard on June 25, when the Commercial Vehicle Safety Alliance (CVSA) added ELP violations to its out-of-service (OOS) criteria. No more translation apps, cue cards, or interpreters during inspections—if a driver can’t chat clearly with an inspector or explain a stop sign, they’re sidelined immediately.

But ELP is just the tip of the iceberg. On September 29, FMCSA dropped an emergency interim final rule, Restoring Integrity to the Issuance of Non-Domiciled CDLs, slashing eligibility for foreign-issued or non-U.S. resident licenses. Only holders of specific visas (like H-2A or H-2B) can now qualify, with mandatory SAVE system checks and annual in-person renewals. This targets the estimated 200,000 non-domiciled CDL holders—many from Mexico and Central America—who’ve been a quick-fix labor pool for years.

The result? A firestorm. By October, ELP violations hit 18,062 nationwide, with over 5,000 OOS orders—mostly along the U.S.-Mexico border. Non-domiciled rules could boot another 194,000 drivers over the next two years as renewals lapse. States like California (25% improper issuances) and Texas (51,000+ since 2015) are under audit, with six pausing new issuances entirely.

Legal pushback is fierce—a D.C. Circuit stay in November temporarily halts the non-domiciled rule, but enforcement rolls on. Even the CVSA is calling for clearer, non-redacted guidance to avoid confusion. X is ablaze with trucker frustration: "CA ignored ELP for 14 years—now lives are at stake," posts one advocate. Another warns of "wage suppression" from migrant labor floods since 2021.

The Crisis Unfolds: Driver Shortages, Capacity Crunch and Safety Wins

Picture this: Your fleet’s down 10-15% on routes overnight. That’s the reality hitting carriers hard. FMCSA estimates a 5-12% hit to the total CDL pool (214,000-437,000 drivers), exacerbating the perennial "shortage" myth—now very real for cross-border hauls. Freight volumes are stagnant, but with 310,000+ trucks added since 2019 via lax rules, capacity was artificially bloated. Now, it’s contracting fast—FTR Intel predicts peak utilization by Q4 2026, with rates spiking 15% as demand outstrips supply.

Safety stats tell a darker tale. Non-domiciled drivers account for just 0.2% of fatal crashes, but FMCSA flagged five deadly ones in early 2025 alone. Lax enforcement since Obama’s 2016 memo (which nixed OOS for ELP) fueled "CDL mills" churning unqualified hires, hiking insurance premiums 40% post-accident. Immigrant-heavy fleets face audits, lawsuits, and broker blacklists—think the Singh family crashes tied to fraudulent CDLs.

For small carriers, it’s existential: Turnover was already 90%+; now, add OOS downtime and visa chaos. But here’s the revival angle— this forces a pivot to domestic talent. CDL issuances are up 17% since 2016, with grads earning $100K+ straight out of school. Regional demand in the Southeast and Midwest is exploding for reefer and HAZMAT roles ($80K-$120K), where English-fluent locals thrive.

The Recruitment Revival: Turning Pain into Opportunity

Silver lining? This crisis is weeding out bad actors and rewarding smart recruiters. With non-domiciled drivers exiting (97% won’t re-qualify), fleets must innovate— and that’s where platforms like Jobpeak.io shine. We’re seeing a 70% uptick in domestic applicant traffic since July, as word spreads: American drivers are in demand, with better pay and respect.

Here’s how to capitalize:

Audit and Upskill—Now

- Action: Review your roster via FMCSA’s Driver Qualification Files. Flag non-domiciled/ELP risks and offer ESL classes (many community colleges tailor them for truckers).

- Win: Cut OOS by 30% and boost retention—drivers who feel invested stay longer.

Target Domestic Hotspots with Precision

- Action: Focus on high-yield regions like Florida (training expansions) and Texas (oil/ag hauls). Use Jobpeak’s geo-targeted searches for endorsements like doubles/triples—quick wins for $10K+ bonuses.

- Win: Fill seats 50% faster; our data shows temp-to-hire roles exploding for locals.

Leverage AI and Omnichannel Outreach

- Action: Ditch cold calls—AI tools score leads and automate SMS/email follow-ups. Jobpeak's SaaS is slashing ghosting by 50%.

- Win: Contact rates hit 70%, per industry benchmarks. Pair with referral bonuses for vetted Americans.

Embrace Retention as Your Secret Weapon

- Action: Transparent pay ($65K+ in high-enforcement states like NY/IL) and quick check-ins cut turnover 30%. Partner with schools for sponsored training—ROI in six months.

- Win: The "shortage" flips to surplus of loyal talent, stabilizing your ops.

What It Means for Your Fleet: Navigate or Get Left Behind

This 2025 crisis isn’t ending soon—the non-domiciled stay could lift, and ELP enforcement is here to stay. But it’s sparking a healthier industry: Safer roads, fairer wages, and a recruitment renaissance that favors fleets like yours. Insurers are already praising the shift, with fatality risks dropping as unqualified drivers exit.

The bottom line? Act fast. Platforms like Jobpeak.io aren’t just job boards—they’re your edge in this revival, connecting you to 1.4M+ opted-in, ELP-ready drivers. Sign up today for a free audit and watch your fleet thrive amid the storm.

Ready to revive your recruitment? Start with Jobpeak.io and fill those seats before 2026 hits. Questions? Drop us a line!

Sources: FMCSA.gov, FreightWaves, FTR Intel, Overdrive, and industry X discussions. All data as of Dec 1, 2025.